The overabundance of sitting aircraft and the retirement of older models, increases passenger to freighter (P2F) conversions. But is this sustainable?

While the pandemic has disrupted many industries, commercial aviation sees the greatest peacetime challenge it has ever faced. But as we’ve seen, cargo is a different story. With a very large proportion of cargo normally being carried in the belly hold of airliners, that capacity is gone. This capacity reduction raised prices enough to make cargo operations a booming business. It even made freight-only operations in passenger jets feasible, if not outright profitable.

This unanticipated workload gives freight carriers some extra cash flow. Many wish to invest it back to their companies, to bring forward fleet renewals. However, they are keenly aware that this high demand won’t last forever. With Covid-19 vaccines now cleared for use around the world, passenger jets will return to service in the coming months. Full recovery will take years, of course. But many of their new cargo aircraft or freighter conversions will take that long to enter service, too.

It’s worth remembering that there are more factors at play here than just the pandemic. There is a confluence of aircraft fleet retirements and renewals, all happening at roughly the same time. This had started long before the pandemic. Already before the introduction of Boeing’s 787, a steady stream of second-hand 767s started coming into the market. And these conversions are still coming, while new freighter 767s are still leaving Boeing’s factory.

More Freighter Conversions

And this was only the beginning. A330 conversions got underway, replacing or supplanting a lot of freighter A300s. More recently, retiring Boeing 777s gave rise to P2F conversions for them, even before the crisis. And now narrowbody operators are renewing their huge fleets. Many Airbus A320ceos will return to lessors, as A320neos take their place. An increasing availability of Boeing 737-800s mirrors this, as the MAX comes back into service.

This acceleration of fleet renewals in the passenger side of aviation is a big part of why plane values are coming down. Estimates put the value of 15-year-old planes down 20% to 47% (depending on the model) in 2020 alone. 15 years is the average airframe age of freighter conversions. As we saw, even Embraer is looking at a P2F program for its E190-195 aircraft, as a way to drive sales of the newer (E2) versions.

And there is a number of companies already active in passenger to freighter (P2F) conversions. Among them there is Singapore Technologies (ST) Engineering Aerospace Ltd, Israeli Aerospace Industries (IAI), Elbe Flugzeugwerke (EFW) in Germany and Aeronautical Engineers Inc. in the US. And they are busy. Estimates say that P2F conversions will rise by 36% year-on-year over the next two years according to Cirium, an aviation analytics firm. Chris Seymour, Cirium’s Head of Market Analysis, said:

“There is an increase in newer-generation programs, notably the 737-800 and A321 as well as the A330, although older types like the 767 continue to see strong demand, driven in the past few years by Amazon building their own fleet.”

Air Freight Demand – And Supply Of Freighters

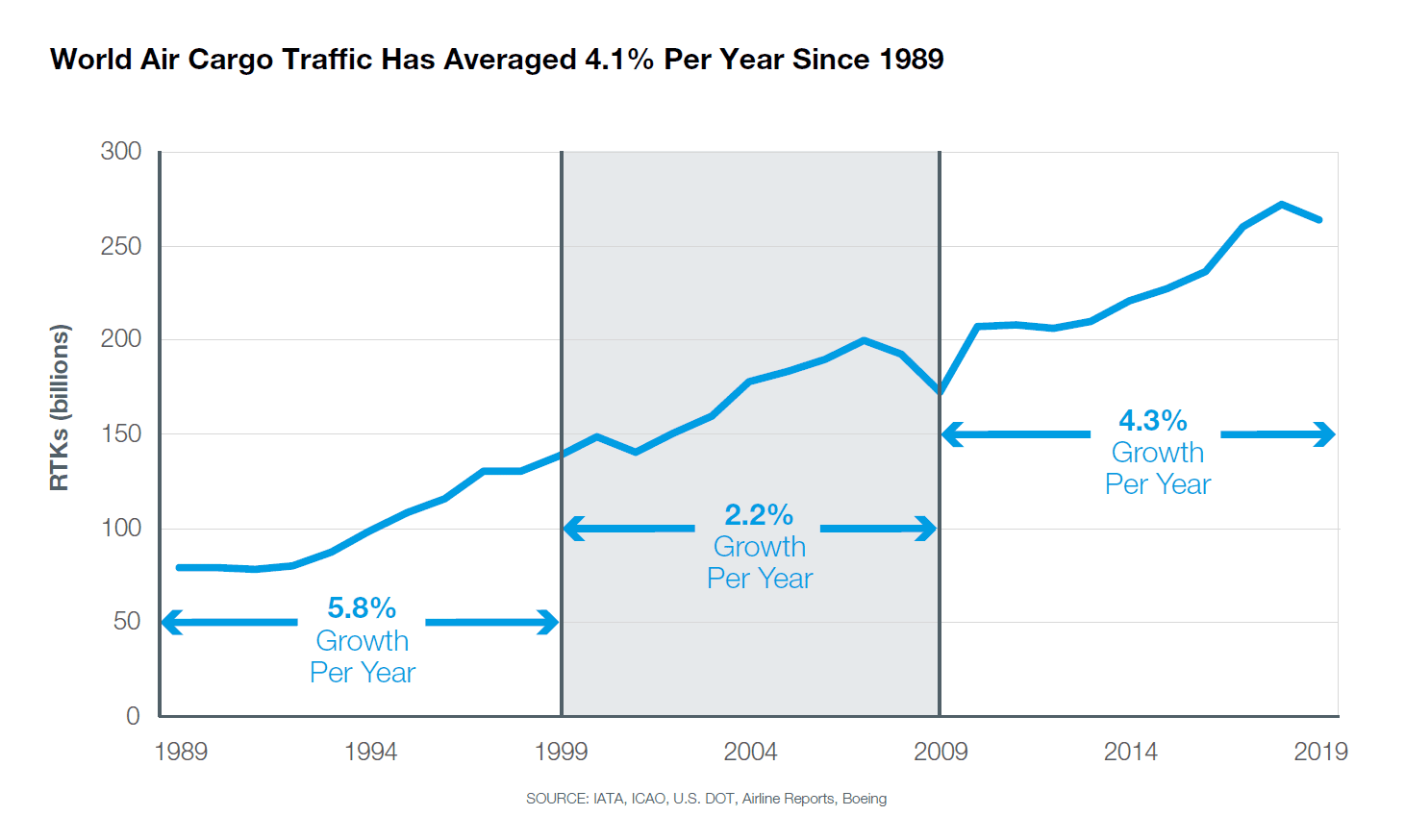

Last month Boeing published its latest update on its long-term cargo forecast. They see a 4.1% rise, year-on-year, going back over 25 years. Singular events like 9/11 and the 2008 market crisis affected rates for a short time. But as the graph shows, the market eventually bounced back to the same rate.

This is largely down to e-commerce. And if anything, the pandemic and the long lock-downs have turned people even more towards on-line shopping. But even if long-term growth remains at ~4%, cargo operators know that there will be demand for their newer, fresher freighter conversions.

So conversion companies are busy. ST Engineering expect to convert at least 18 Airbus A321s in 2021. They only converted half as many in 2020. And those 18 slots for 2021 are already full. They expect demand for 25-30 aircraft per year, from 2022 onwards. And another trend these companies see is newer and newer aircraft coming in, for conversion. The rule of thumb that P2F planes start out being 15 years old, may be up for review. But this is likely a temporary effect.

And this is only for conversions. But one purpose of the Boeing cargo forecast that we see further up, was to examine whether or not Boeing should add new freighter aircraft to their manufacturing plans. Boeing still hasn’t announced a freighter version of its 777X, or 787 aircraft. That could soon change… but even if it does, P2F conversions will be a much faster and more affordable path to air freight.