Mitsubishi acquired the rights for Bombardier’s CRJ700 series but had no plans to continue its production. Could this be changing? And why?

On multiple articles, we saw that the list of airlines that closed their doors in the pandemic was much smaller than many feared. This was largely thanks to government support – with airlines that closed suffering the lack of it. But if most airlines weathered the storm, new aircraft programs like the Mitsubishi SpaceJet, were pandemic casualties.

The SpaceJet would be Japan’s first indigenous airliner design since the turboprop NAMC YS-11 in the 1960s. The MRJ (Mitsubishi Regional Jet), as it was first called, would become the new standard for the market, in terms of efficiency. This is thanks to two Pratt & Whitney GTF PW1200G engines, plus an up-to-date design, using composites and modern alloys. And it went far beyond a paper project.

But from the outset, the program faced long delays, from multiple radical changes in design, plus the engines. However, by early 2020 it seemed that Mitsubishi had put most of these problems behind them. They had already built ten aircraft, and certification testing was well underway, both in Japan and the United States. Early production jets, sporting the colours of customer airlines, were already featuring at airshows.

Mitsubishi And US Scope Clauses

By late 2019, Mitsubishi had over 200 orders for the aircraft, with nearly as many options. About three quarters of firm orders were from regional airlines in the United States: SkyWest and Mesa Airlines. Mitsubishi had done its homework, sizing the aircraft for the unique requirements of the US scope clauses. These are agreements between airlines and pilot unions in the United States. They place strict limits on aircraft weight, passenger capacity and fleet size, for regional aircraft fleets.

Facing a very uncertain post-pandemic aviation environment and with limited finances, Mitsubishi took the decision to freeze the SpaceJet program. This happened at the end of October last year, following severe cuts to the program in the preceding months. All certification efforts outside Japan stopped immediately. The manufacturer stopped short of canceling the program – officially at least. However, there has been little (if any) activity on it since.

So, where does the CRJ700 family fit in this story? Well, Mitsubishi had acquired the CRJ program before the pandemic. This would give them a decent income from maintenance work for the world’s CRJ fleet. Also, it would give them experience, plus an excellent north American base for future support of the SpaceJet program. They kept the production line going, to finish production of 15 CRJ900s.

One Design Frozen, Another Retired

Afterwards, Mitsubishi put the tooling in storage, handing over the Mirabel production building to Airbus, who expanded A220 production there. But stopping the CRJ program seems to have had some unexpected effects. The problem is that a lot of existing users of CRJ700 series of aircraft, wanted to replace them with Mitsubishi’s SpaceJet. And with the latter perhaps out of the picture for good, there seem to be calls for reviving the CRJ700.

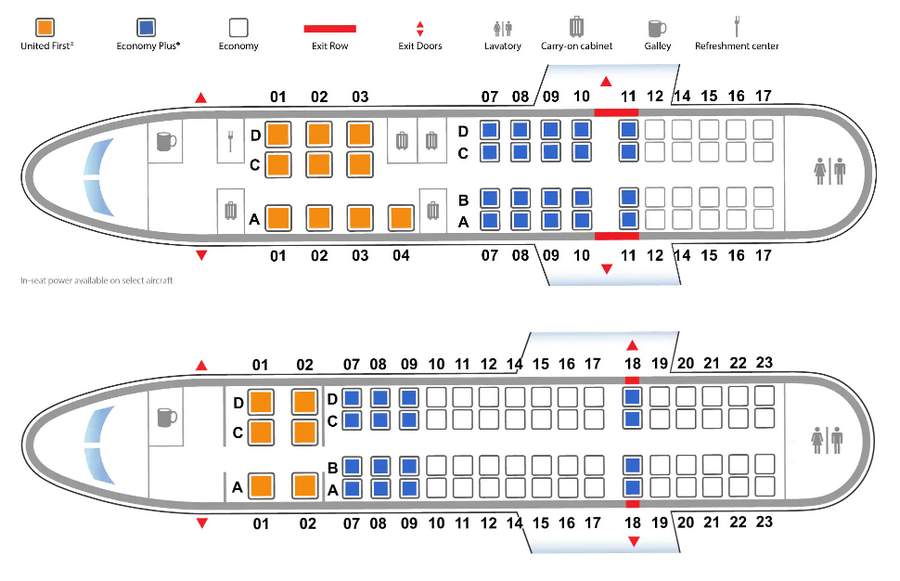

More specifically, Leeham News is reporting that Skywest Airlines want new CRJ700s in a CRJ550 configuration. This is a 50-seat version of the CRJ700, differing only in its internal configuration (see above). With fewer seats and a lower gross-weight limit, to comply with 50-seat scope clauses, these aircraft became popular with passengers. Bombardier only introduced the CRJ550 in January 2019, months before Mitsubishi took over.

The CRJ550 solved a problem for airlines selling multi-leg trips to business or first-class passengers. Until then, if you wanted a 50-seat aircraft, you had to choose between the Embraer EMB-145, or the older CRJ200. The problem with both is that they have 50 seats in a single-class configuration. Some rows may have more legroom, but there was little else that airlines could offer to their ‘premium’ passengers.

Being the same as the CRJ700 (the first ones WERE 700s, modified after the fact), the CRJ550 has three-class seating. So these jets match the mainline fleet’s offerings much better. Plus, they offer extra space for carry-on, and decent legroom even for economy passengers. Efficiency-wise, the per-seat cost is worse than the CRJ700s, but comparable to that of the older, smaller CRJ200. And it seems SkyWest is ‘courting’ Mitsubishi, to set up production once again.

A Wrong Move From Mitsubishi?

With the pandemic mostly (?) behind us and the resultant benefit of hindsight, we can see some interesting lessons. And possibly, a miscalculation from Mitsubishi. Airlines and everyone else with a close connection to aviation or hospitality, suffered in the pandemic. But regional airlines in the US fared much better than anyone else, as we have seen. With no cross-border restrictions to worry about, companies like Mesa Airlines even remained profitable in 2020.

So with the rest of the industry now recovering, the regionals want to keep their momentum going. United recently announced an over-reliance on 50-seat aircraft, but are happy with the CRJ550. Trans State Airlines operates these jets for United. And if SkyWest gets its way with Mitsubishi, they may get more.

In terms of efficiency, the CRJ700 family uses the same engines as the first generation of the Embraer E175 family. Embraer can’t fit the newer P&W GTF engines (of the E2) to the smaller E175 and meet the maximum weight for the 76-seat scope clauses. This is the category that the ‘normal’ CRJ700 fits into. Embraer is still making the older E175 E1, for this reason. And Mitsubishi?

The situation means that Mitsubishi now has an interesting dilemma. The CRJ700 and 550, not to mention the bigger 900 and 1000, are certified and ready to go. Setting up production once again would be a major headache. Not only that, a lot of the staff working that line will now have moved on – possibly to Airbus. If Mitsubishi restart production, it would make sense to do so in Canada, combining it with their MRO activities.

Old Vs New?

But in an ideal world, the jet that should be doing this is the one Mitsubishi designed in the first place: the Spacejet. The M100 version of the new, lightweight design, fits the 76-seat scope clauses perfectly. And that’s with the same engines that are too heavy for the E175-E2 to fit the same clauses. However, before freezing the SpaceJet program, the plan was to introduce the M100 in 2023, after the bigger M90/M200.

So what is Mitsubishi going to do? In the end, the decision may depend on available funds. When the Japanese company halted the SpaceJet, they diverted resources to the design of a stealth fighter for the military. So it is quite likely that any decision they make on that front, will need approval from elsewhere.

With nothing else available, a premium-heavy, 50-seat SpaceJet M100, could corner the 50 seat market in the US. If Mitsubishi takes the plunge, they could be playing solo for a decade – or until Embraer brings their new turboprop design to market. But can they do it?

This is one to watch.